There are several important steps to start your own FinTech company in 2022. According to recent data, the FinTech market is projected to reach nearly $300 billion by 2025. In addition, nearly 65% of all financial transactions are made online. With such a high demand for FinTech in ecommerce, banking, and cryptocurrency sectors, financial technology adoption is up nearly 50%. As an entrepreneur in the tech industry, you need to know the proper steps to launch your own FinTech business. This way, you can take advantage of the lucrative market opportunity and develop secure solutions for your growth of a business. Read on to learn about how to start your own FinTech company in 2022.

Identify Your Niche

First, identify your niche before you start your FinTech company. Indeed, the FinTech industry has a wide range of subdomains to consider. For example, you could develop technology for payments and international money transfers. Or, develop platforms for lending, personal financial management, or mobile banking. If you have a deep understanding of stocks, you could target your company towards trading and investment technology. On the other hand, you can also target your services towards small businesses. Then, develop solutions such as accounting, tax, or payroll software. Of course, the cryptocurrency sector is a great avenue for blockchain developers. In short, identify your niche so you can start marketing your products to your target demographic.

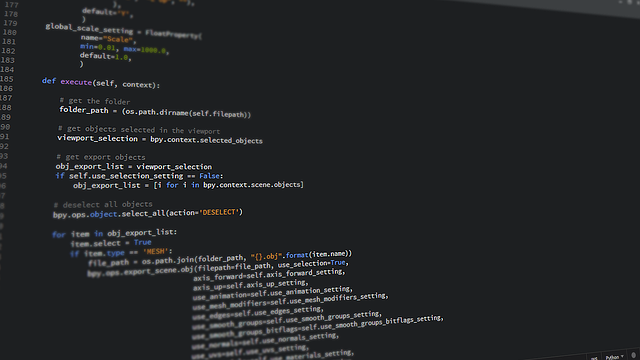

Gather Advanced Tools

Next, gather advanced tools to start your own FinTech company. For example, some of the world’s top banking companies power their software with the JFrog Platform. With access to an advanced container registry and software composition analysis tool, banks can modernize their enterprise software development process. In addition, this solution can accelerate cloud native development with private Docker and Helm registries. Simultaneously, deliver more frequently with daily application and update deployments. Notably, this platform also enables Cloud migration so companies do not need to host on servers in their data centers. For many enterprises, this enables automation, faster iterations, and high-quality releases. In short, gather advanced tools to start your FinTech development company.

Study Key Regulations

In addition, you should also study key regulations when launching your own FinTech business. For example, you need to comply with anti-money laundering policies to minimize suspicious activity associated with your business. Additionally, you should follow the Know Your Customer standard if you’re taking on investments. This way, you can gather detailed information about your client’s risk tolerance and financial position. Of course, you should also follow the Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation to protect sensitive data. More so, follow standards from top regulatory bodies like the FDIC and Commodity Futures Trading Commission. Absolutely, study key regulations to maintain compliance in your organization.

Build Your Team

Moreover, build your team before you launch your FinTech company. Ideally, you should have one or two co-founders who can work with you to build a solid business foundation. For example, you can work with experienced Python developers, cybersecurity professionals, or financial experts. Of course, your team should share a common vision for your company so you can start working towards a sustainable product. As you build your team, decide how you want to divide the company’s equity stake. Typically, you should keep the founder’s parts equal unless contributions were drastically different. Additionally, skills and expertise level can also impact how you split it up. Undoubtedly, build your team before you launch your FinTech business.

Secure Funding

Furthermore, secure funding for your FinTech startup to ensure successful product launches. Consider raising your own funds through bootstrapping if you’re in a secure financial position. In addition, you could launch a crowdfunding campaign to generate small amounts of capital from large numbers of people. If you set up your crowdfunding on a donation basis, you do not need to pay back your investors. Of course, consider venture capital or traditional banking loans if you need a larger amount to cover startup costs. Typically, startups employ a few different strategies to get the funding they need. If possible, you can also build prototypes of your products to show potential investors and attract additional funding. Certainly, secure funding for your FinTech startup to launch your business.

There are important steps to start your own FinTech company in 2022. First, you should identify your niche to decide what type of solution you want to provide. Next, gather advanced tools so you can build your technology. In addition, study key regulations in the FinTech industry to maintain compliance. Moreover, build your team so you can start dividing the equity. Furthermore, secure funding for your startup so you can start gathering clients. Consider these points to learn about how to start your own FinTech company in 2022.