A home equity loan Toronto is a way to obtain money against your home. There are many benefits to using this type of loan, and various purposes are appropriate for it. You can use the money for many things, including debt consolidation, education, and even a vehicle. Using the money from your home equity loan will improve your financial situation and benefit your future. The money you raise from a home equity loan can be used for small and large loans.

A home equity loan Toronto is a great way to pay off credit card debt, and a home equity loan can help you spread payments over a longer period and use it for just about anything. If you want to use the money for anything, your Capital Direct mortgage specialist will help you find the best solution for your situation. The money can also be used for home repairs, improvements, or even a vacation.

A home equity loan can be obtained through a mortgage refinance Toronto broker or lender-direct. A home equity loan is usually processed much faster than a traditional bank mortgage. Private lenders are usually more willing to risk in exchange for a higher return, but they may charge higher interest rates and fees. If you need money quickly, you should consider a home equity loan Toronto. The key to getting one of these loans is to know what you want to do with the funds you borrow.

The housing market in Toronto is among the highest in Canada, and rising home prices have made it possible for homeowners to use their home equity as leverage to access more funds. Home equity loans Toronto are a viable solution for debt consolidation in the city. Whether you want to take advantage of your home’s equity to pay off a large debt or use the money to upgrade appliances, a home equity loan can help. You can also use the money to remodel your house or upgrade your appliances. There are several uses for home equity loan rates Toronto, and these vary depending on the situation.

Loans Geeks can help you find the best option for your financial situation if you’re looking for a home equity loan in Toronto. By utilizing your home’s equity, you’ll have more flexibility to pay back the loan and balance your wants and needs. Using the money you make from the equity in your home, you can go on vacations, renovate your home, pay for education, and invest in opportunities. It’s a win-win situation for everyone.

Another use of home equity loan rates Toronto is for debt consolidation. If you’re a homeowner with multiple debts, a home equity loan will help you eliminate them at once. Because you’ll only be paying one lender each month, it is easier to manage your finances. Additionally, you can refinance your loan to get better terms and interest rates. This is a great way to make your home more valuable to potential buyers.

A home equity loan can be a good option if you have poor credit. The lender will use your home as collateral and will not consider your existing first Mortgage loans Toronto. You’ll be able to apply for a loan without a credit check or income verification. Once you get approved, the process is simple and quick. Once you’ve decided to apply for a home equity loan, your lender will evaluate your financial situation and determine whether you’re a good candidate for the loan.

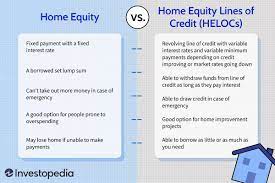

Two types of home equity loans are available in Toronto: a home equity line of credit and a home equity loan. A home equity loan Toronto is a lump sum of money you borrow from the lender. The amount can be as small as you need, while a home equity line offers a line of credit. With both, the repayment term is usually between 10 and 20 years. The interest rate is usually variable, but some lenders have fixed-rate options. When comparing home equity loan Toronto, be sure to compare the interest rates and terms of each type of loan.

While a home equity loan isn’t a good choice for every borrower, there are many benefits to this type of loan. Home equity loan Toronto is ideal for people struggling to make payments or needing a larger sum of money to consolidate multiple debts. The amount you borrow can be used to consolidate other debts, putting you in a more stable financial situation in the long run. The loan can be used for various reasons, including purchasing a new vehicle or buying a home.